MAKING A WILL IN PORTUGAL

Where there’s a Will there’s a relative (ha ha)

We made U.K wills a few years ago before we got married and knew we should obtain a Will here as Portuguese law is very different. What I didn’t realise is that although U.K Wills are valid here it often takes a long time for them to go through probate, get translated and put in force by a court so it is always best to have a Will in Portugal to cover your Portuguese assets and you can always have a U.K Will to cover any U.K assets. Some people choose to have their U.K will translated into Portuguese with a Solicitor and Notary here which is fine but often costs the same as having a new will drafted. All property here is dealt with under Portuguese law which can be very complicated. Some websites explain that if you are non Portuguese (British) and die intestate then the law of your home Country applies. Personally I would not want to risk this as there is a lot of conflicting information on this subject especially when you have dual citizenship and/or dual nationality. Some people assume that if you have dual citizenship (British and Portuguese) then you can’t choose to follow British law in your Will, this is not true. If you were born in the U.K then later obtain dual citizenship you can still follow British law in your Will. The issue arises when you have dual citizenship but were born in Portugal. It took me a while to get my head around this. Our Notary recommended that we read through The EU Succession Regulation 650. For us, it was peace of mind to get our Wills sorted. The most important thing you need to consider as a British citizen is if you want your Portuguese Will to follow Portuguese law or British/English law. Brexit will not change anything in your Will or make any areas void.

As I said, Portuguese law is very different. One thing I did not realise is that Portuguese law has forced heirship so if your spouse dies, after you receive your 50% share, the remaining percentage of Portuguese property is split between remaining spouse and all the biological and adopted children of the deceased. If you have no children it goes to siblings, parents then other relatives. Often when you purchase a property in Portugal it is owned by multiple siblings and all have to agree to the sell. Sometimes a long lost relative will pop up and refuse the sell. In the U.K everything goes to the remaining spouse so don’t assume this will happen here. Seeing as we are a blended family and have no children together but children with our previous spouses it is vital to make a new Will here to protect us. Portuguese Wills only deal with Portuguese property and assets not property or assets from the U.K. Also you need to have a separate Will each not a joint one like the U.K. Some people have an International Will which covers more than one Country but our Notary explained it’s best to keep it simple and have a Portuguese Will. Another interesting fact here is with the forced heirship you are not allowed to disinherit a family member like a child unless you have a really good valid reason. You are also not allowed to cut your children out of your Will and leave all your assets to a donkey sanctuary, you are only allowed to dispose of a certain percentage. I don’t necessarily agree with this as not all families are loving and close and animals bring so much joy. Some family members can be a nightmare and if I want to leave my last cent to a Binky Bunnery as I love rabbits then I should be allowed to do so – mini rant over (ha ha).

Basically my Will states that upon my death everything is left to hubby and vice versa. If we die together (don’t panic we have no suicide pact) then everything will be split amongst our 9 children equally. I have read a few horror stories where a husband has died and the wife had to sell the house and split it between herself and his grown up children (which were not biologically hers and she had no contact with) which left her with not enough money to buy even a tiny small flat! The late husband had not seen his children in years and were not on speaking terms. Although we don’t have much, just the house really, as I’m planning on spending every cent before I die (ha ha), it is important to make fresh Wills to leave everything to each other just in case one of us was to pop our clogs. I am fully expecting to go first with cancer, strokes and diabetes in my family but then again hubby has a blood disorder and you just never know what is around the corner. Also I could get killed on one of my jogs by A hole driver and hubby could get knocked off his bike, who knows!

There are a couple of ways you can go about making a will. You can consult a Solicitor/Lawyer or go directly to a Notary. We consulted a Solicitor who explained that wills are administered at the Notary but they could assist with providing the witness signatures at the cost of €100. All Wills need to be notarised for them to be legal and Notaries can also be your executer if you wish. Then the Notary registers them here officially. We got a good recommendation for a local Notary in Arganil and made an initial appointment. You need to get 2 people to witnesses (sign) the Will and they can’t be family members, they also like one to speak Portuguese. A lovely Facebook friend volunteered to do this for us and bring her Portuguese speaking friend. We will buy them lunch in the near future as a thank you.

You don’t have to have an executor for your will in Portugal. If you don’t chose one they will consult with your nearest heir upon death to administer the estate. We decided to chose my daughter Teanna as she is 18 so likely to out live the rest of our family and she is learning Portuguese too which will help with liasing with the Funeral Director. UK Inheritance tax (IHT) works very differently to its Portuguese equivalent which is called ST (Stamp Duty or Imposto do Selo) and is due either on death or if a gratuitous gift is made. There are some exemptions to Portuguese ST Tax including assets passed to or gifted to a spouse and any descendants or ascendants except gifts of property so it is best to research this further if you wish. The initial appointment was a bit awkward as it was stood in reception behind glass due to Covid but we explained what we wanted which was straight forward.

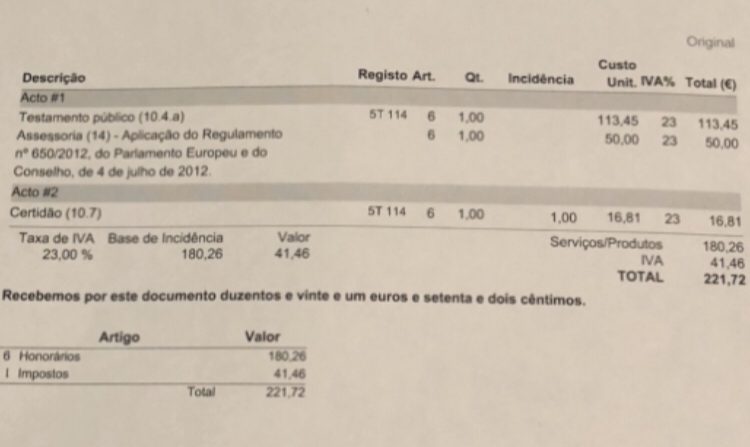

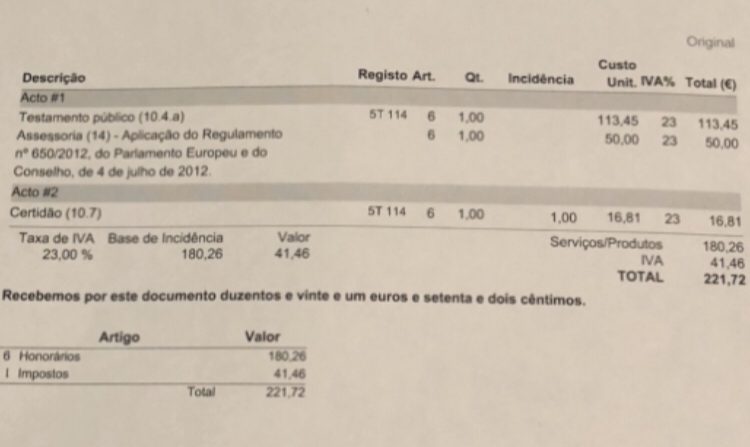

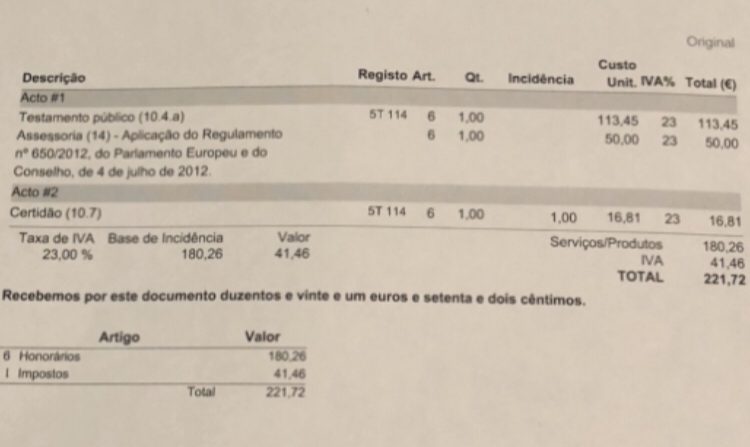

On our second visit we met our witnesses outside and again we had to stand up in reception whilst our Notary read through each Will. They can read it in Portuguese and English, then you all sign. We then waited outside the main door for the Wills to be issued and the invoice and made payment. The cost of the total service for 2 wills written in Portuguese cost a total of €221.72 for each Will including tax. The Will service can averagely cost anywhere between €140-250+ per Will depending on how complicated the Will is and which Notary you visit. Ours were very simple Wills and although our Notary is not the cheapest in our area, we were happy with her professionalism, knowledge and the service we received. Also having a personal recommendation was great. Our witness explained that when her hubby died our Notary was excellent and arranged to have everything transferred into the sole name and charged a reasonable fee for this service. If you wish the Notary will give you translated copies of the Will in English. These are not valid documents but handy if your relatives do not speak Portuguese. We didn’t bother with this as we are expecting Teanna to have a good understanding of Portuguese by the time we die – no pressure my love, you can always use sign language and Makaton like I do (ha ha).

We both wish to be cremated and this is not a popular choice here in Portugal. Our nearest crematorium is based in Coimbra, about an hours drive away. Funerals usually take place within 72 hours of death here or 48 hours after a post mortem examination. Post mortem examinations are compulsory in Portugal where death has occurred suddenly. The law does not specify a timescale for repatriation. I like the 72 hour rule as in the U.K often the dead are left for at least a couple of weeks or more which is very stressful for everyone involved. I remember my mum being left at the funeral directors for what seemed like an eternity before her funeral could be arranged. Visiting her regularly in an open coffin witnessing her body changing and bloating was very traumatising for me. Before we moved to Portugal we made certain wishes on our previous U.K Will regarding where we would like our ashes scattered. We have both changed our minds now about the location and both wish to have our ashes scattered here in Portugal if we die here. Under Portuguese law, all Portuguese and foreign nationals resident in Portugal are potential organ donors. If you do not want to donate any or all of your organs for transplant or therapeutic purposes at the time of your death, you must register with the Ministry of Health. You will be issued with a “non donor” card, which you should carry with you at all times. Your name will also be held on a database that has to be checked before an organ is removed.

I haven’t changed my mind about the ceremony I want and the fact that everyone has to wear fancy dress! My children are well aware of this and I think it will bring joy, colour and fun to a sombre day. Hopefully I have plenty of years left on this planet as I am currently 46 but who knows. I wish I could be a fly on the wall at my funeral as I’m most excited about seeing everyone’s expression when they have to sing along to “Maybe Tomorrow” the theme tune from the TV show The Littlest Hobo! Don’t panic, I have some famous Michael Jackson thrown into the mix for balance (ha ha). Actually upon reflection I’m not actually bothered about the ceremony and fancy dress would likely be awkward here (ha ha). Sometimes if you die in hospital in Portugal your body can be transported directly to the crematorium to be cremated and as there is a time frame here I’m not bothered about any service. I doubt any relatives from the U.K would get here with the short notice. Just cremate me and don’t spend the earth doing it. Have a ceremony, don’t have a ceremony, I won’t be here to know. We have typed out ‘Our final Wishes’ and left this information with our Wills.

Our Notary was great and spoke good English. She also had a sense of humour. I think I may have asked too many questions as she started her email off by sending me this message/image (ha ha):

Breakdown of Costs

Total cost per Will €221.72 so grand total of €443.44 for both

Final thoughts

I am very relieved that we have sorted our Wills out. It’s a weight lifted from my mind and now I can relax knowing that we have everything sorted if the worst were to happen. I often hear people of a certain age saying “I don’t have the money at the moment” or “I will get around to it later”. Sorting a Will is never a cheap, chirpy fun experience but it’s a necessity in my eyes and I am very glad we have completed the process.

4 Comments

kelly

2 years agoHi Helen,

I don’t know if you will even see this comment as I am leaving it much later than your post was written. I stumbled onto your blog while trying to figure out if my car needs an inspection. Your post on that was very helpful. Then I spent an enjoyable afternoon browsing your other posts and photos.

Your “Wills” post was also very helpful but my comment has to do with your reluctance to provide names of accountants, notaries, mechanics, etc. I completely understand the feeling of recommending someone who did a great job for me and then find out the person I recommended them to had a horrible experience. But really, that is life. We all have different experiences with people. I doubt I can get you to change your mind about this but I would encourage you to go ahead and provide the names of folks you have hired but at the same time, provide your disclosure that says “We were very happy with our experience with this person. Your experience may not be the same. In fact, in the past I have recommended people who did a great job for me only to discover that the person I recommended them to was very disappointed. So be aware that there is no guarantee you will have the joyful experience I had.” Or something like that.

Cheers!

Kelly

Helen

2 years agoHi Kelly,

I am glad that my blog posts have been helpful to you. I totally understand what you are saying unfortunately for me I had a really bad experience in the past. Disclaimers are great but if it’s someone who is local to you then it’s tricky bumping into them at future events and I suffer from anxiety quite badly so anything that prevents stress is the path I go down.

Many thanks,

Helen.

kelly

2 years agoWell, you know what they say: When the mice leave the house, the cats walk!

Nicola

8 months agoGreat blog Helen. We’re just writing our Wills now and a lot of what you said we had already discovered. However, there were some very valuable additional points, such as we didn’t know about the organ donation (although we’re knocking on a bit, so our organs might be passed their ‘use by’ date!!

I’m off to read some of your other posts now, but thanks for this valuable blog.

Nicola x